A word of caution from a suspicious lawyer . . . .So instead of downsizing our massive behemoth of government bureaucracy, Congress passed the CARES Act, establishing the so-called Paycheck Protection Program (PPP), which allows the SBA to guarantee 350 BILLION in loans to help small businesses. As of April 16, 2020, a total of 1,661,397 loans have been made through 4,975 lenders nationwide, eating up all the available money thus far.

Many businesses and investors believe they’re not going to have to pay back these loans. If you believe that, you don’t know government. But there’s way more at stake here than just being required to pay back a low interest loan. Way more. Expect the DOJ to turn their attention to small businesses in the very near future. They’re gonna “help” small business all right….

Take a look at the bill. It’s “Yuge.”

It’s gonna take more government officials to run this thing than would be necessary to run 10 or 12 third world countries. I’m skeptical about who’s paychecks are being protected here. But it’s not just the size of the program that gives me concern. More importantly, these loans have been rushed through, under the hysterics created by the government itself, as well as the media. What does one facing the apocalypse – basically, the scenario of riding motorcycles with spiked shoulder pads – represent on an emergency rushed bank loan application? Therein lies the question of the very near future.

Due to widespread shutdowns, we’re headed into an epic economic depression. That will be a depression for those of us in the private sector. At least at first. They can always take out more debt and print money. But that will collapse too without the forecast of an income stream of real money. The government will want its money from these PPP loans. The government always wants its money. Several quotes come to mind:

- 1. “I’m from the government. I’m here to help.”

- 2. “F*ck you, pay me.”

- 3. “There’s no such thing as a free lunch.”

The False Claims Act (FCA) is a federal law which imposes liability on persons and companies (see “small businesses“) who defraud governmental programs. This law includes a qui tam provision that allows people who are non-government employees (see lawyers and law firms) called “relators” to file lawsuits on behalf of the government. There’s another name for this: “whistleblowers.” Under the FCA, the relators / whistleblowers receive a portion of any recovered damages – generally 15 to 30 percent. This is the basis or all these pharmaceutical lawyer commercials you see on TV. Those lawyers are gonna jump all over this. We need only look to the last “bailout” from Obama’s TARP program in 2008. Just in 2015 alone, the DOJ recovered over 3.5 BILLION in damages under the FCA. And that was the “fourth consecutive year” for such large damages recoveries, as the DOJ proudly announced. It’s an annual expected component of the budget at this point.

Legal experts who practice in the area of the FCA are already warning other lawyers to expect a heightened focus on individuals and small businesses now that these new loans have been made on such a rushed basis. The DOJ recently restated its “commitment to use the False Claims Act and other civil remedies to deter and redress fraud by individuals as well as corporations.”

And it’s not just the private lawyers. Do you think the mountain of lawyers and investigators at the DOJ are going to sit idly by and do nothing? No, they’re ready to get back to work. Remotely of course. In fact, they’ll need even more resources and employees in order to combat the coming fraud crisis you’ll hear about. “With a new national crises at hand, and an even bigger commitment of federal assistance to combat it, expect a plethora of federal and state agencies to join the effort to police recovery spending. Indeed, oversight mechanisms in the act go beyond establishing the special inspector general and include establishing a Pandemic Response Accountability Committee, which is also charged with oversight.” Id.

Now that’s an acronym that ought to scare the hell out of anyone involved in the application of these loans. I can see that on the side of a van pulling up next to front doors in a Polish ghetto, looking for whatever is deemed verboten.It’s not just the applicants, but the bankers as well, and anyone else connected to the process, or the business. The FCA lawyers and the DOJ, using a theory of mere “false certification” of application information, can go after individuals, small businesses, and the lenders who participated in the program. All it takes is to show false information included in the laundry list of certifications in the applications, including, but not limited to:

- the recipients must use the funds to retain 90% of their workforce;

- the recipients must remain neutral in union-organizing efforts;

- the uncertainty of economic conditions as of the date of the application makes the loan necessary to support ongoing business operations;

- the recipient INTENDS to restore not less than 90% of its workforce and to restore all benefits to workers no later than 4 months after the termination of the health emergency;

- the recipient is not a debtor in a bankruptcy proceeding;

- the recipient will not pay dividends to stockholders.

What is “necessary” and who gets to determine what was “necessary?” And who gets to determine what the recipient “intended?” If the FBI can make General Flynn into a convicted felon just by asking their questions in a certain tricky way, what can they do to you? Not only that, but these applicants are also certifying to all other information provided in these applications. Just take a look:

Government doesn’t word things in such a way as to be concise and clear so that everybody’s on the same page. They word things in such a way so that, if they want to get you, they’ll get you:

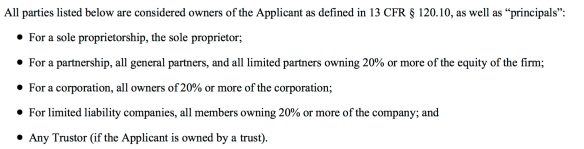

Who’s angus is on the line? It’s not just the person who signs the application, but many other potential individuals within a “small business”:

Lastly, to go after you civilly, rather than criminally, under the FCA, the DOJ doesn’t have the usual constraints of the Bill of Rights and the standard of beyond a reasonable doubt. Instead, they only need to prove the civil standards of “deliberate indifference” and “reckless disregard.” You know, like what happens many times when you rush through an emergency apocalypse relief application. It’s just paperwork….

“If Congress can do whatever in their discretion can be done by money, and will promote the General Welfare, the Government is no longer a limited one, possessing enumerated powers, but an indefinite one, subject to particular exceptions.” – James Madison